Results you can count on start with a capital partner you can trust.

Darin Rayburn

President, Real Estate Equity

Why KV?

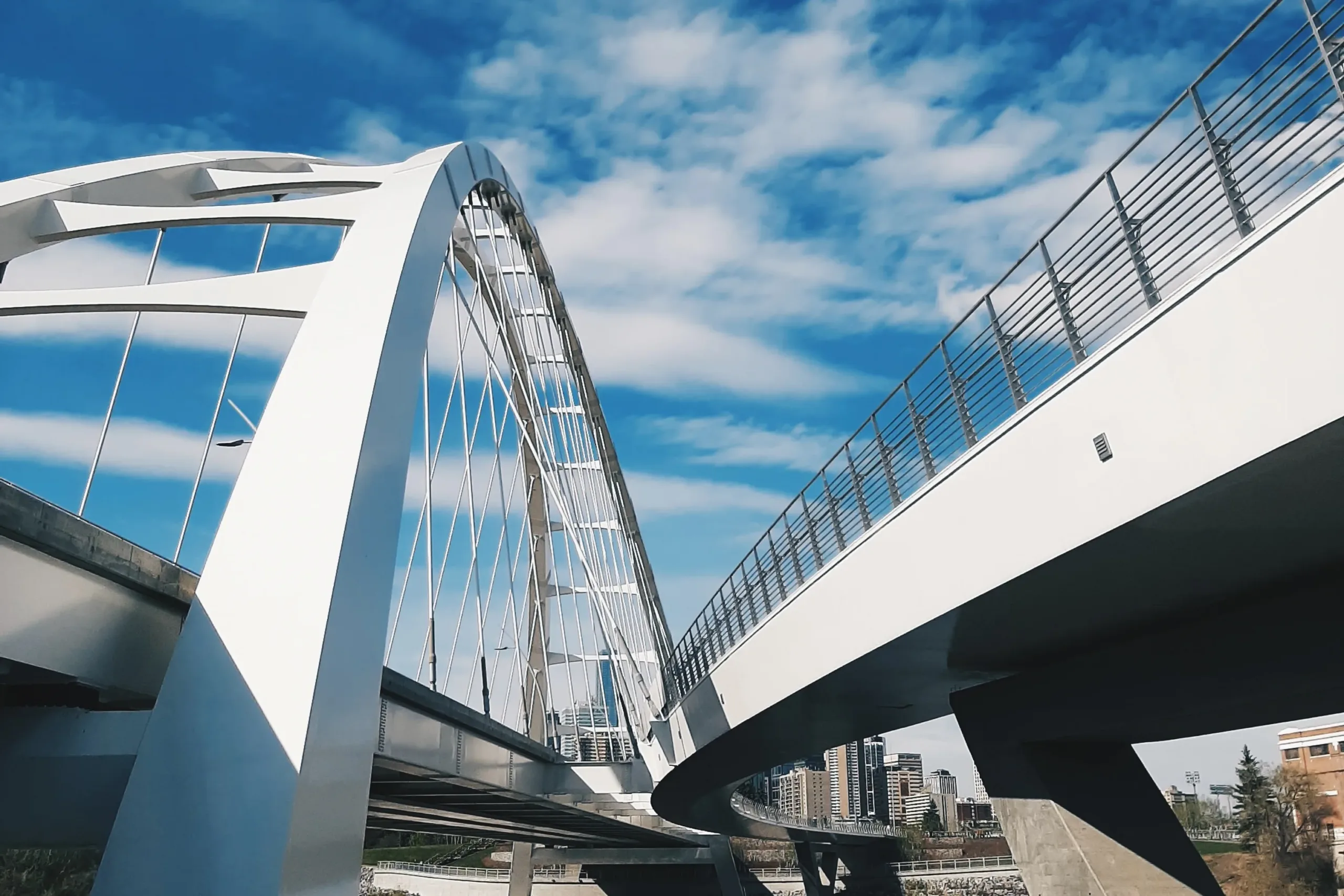

We’re proven deal makers and real estate experts, headquartered in Western Canada.

Our underwriting team possesses comprehensive technical expertise across diverse capital solutions, enhancing your financial outcome.

Our entrepreneurial spirit and agile operations ensure faster turnaround times.

We are committed to transforming relationships into enduring partnerships.

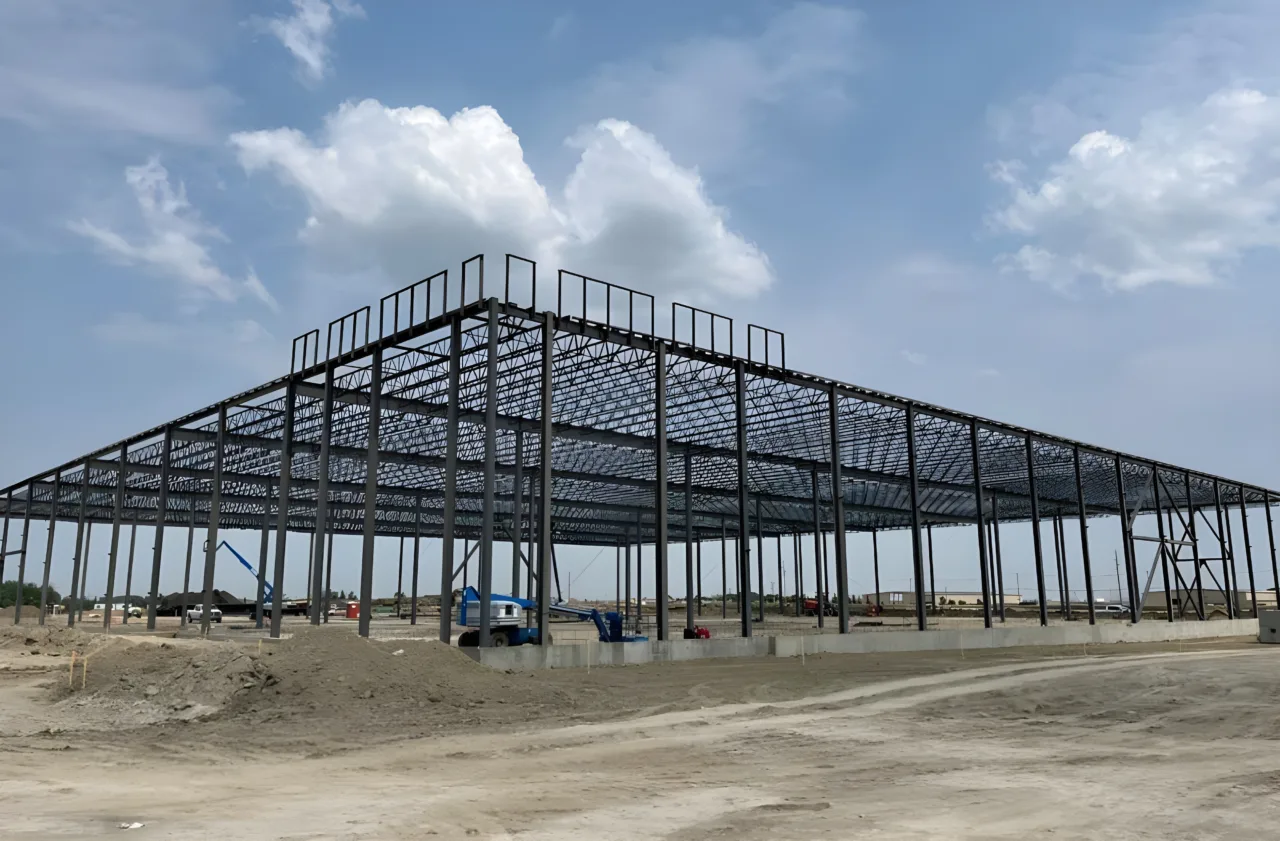

Featured partnerships

Investment criteria

Investment size

The Fund will invest between $2M – $10M with the ability to bring co-investment partners in for larger projects.

Target project timelines

- 2-4 year development horizon

- “Build + sell” projects

- The Fund can participate in flexible exit solutions

Geography

Major western Canadian markets in Alberta, BC, Saskatchewan, Manitoba + Ontario.

Target fund projections are targeted portfolio and/or fund level objectives only and actual investment portfolio, criteria, objectives, and terms and conditions may differ significantly from those described here.

By the numbers

Established in 2022

+$

45

million

in assets under management

$2 – $10

million

investments

2 – 4

year

project timelines

Target fund projections are targeted portfolio and/or fund level objectives only and actual investment portfolio, criteria, objectives, and terms and conditions may differ significantly from those described here.

Relevant insights

-

KV Capital Real Estate Equity Partners Launches Fund II

Fund seeks growth by addressing continued demand for real estate development investment.

-

Inaugural KV Capital Real Estate Equity Partners Fund now fully committed

Full commitment of capital signals new phase of growth.

-

Case Study: Avalon Master Builder

An Alberta-based home builder with a 40-year legacy of success, Avalon has become a leader in building environmentally-friendly homes in Calgary at an affordable price.