We pride ourselves on our commitment to our clients’ success and our deep appreciation that we are stewards of our investors’ capital. Every investment decision we make starts with that understanding.

Nicholas Jeanes

Managing Partner

Why KV?

Demonstrated track record in sourcing, underwriting, and structuring investments to deliver returns in line with investment mandates.

We invest in industries and geographies we know and have expertise in.

A commitment to advancing our clients’ success.

in assets under management in KV Mortgage Fund direct commercial mortgages

in assets under management in KV Real Estate Equity Partner Funds

in assets under management in KV Private Equity Funds

for KV Mortgage Fund

for KV Real Estate Equity Partners Funds

for KV Private Equity Funds

Disclaimer

Actual returns may vary significantly from target rates of return, which are based on certain assumptions and projections. Past performance does not guarantee future performance. Results are not guaranteed. See [Terms of Use | Legal].

Investment opportunities

Invest in a diversified portfolio of primarily first position short-term commercial mortgages.

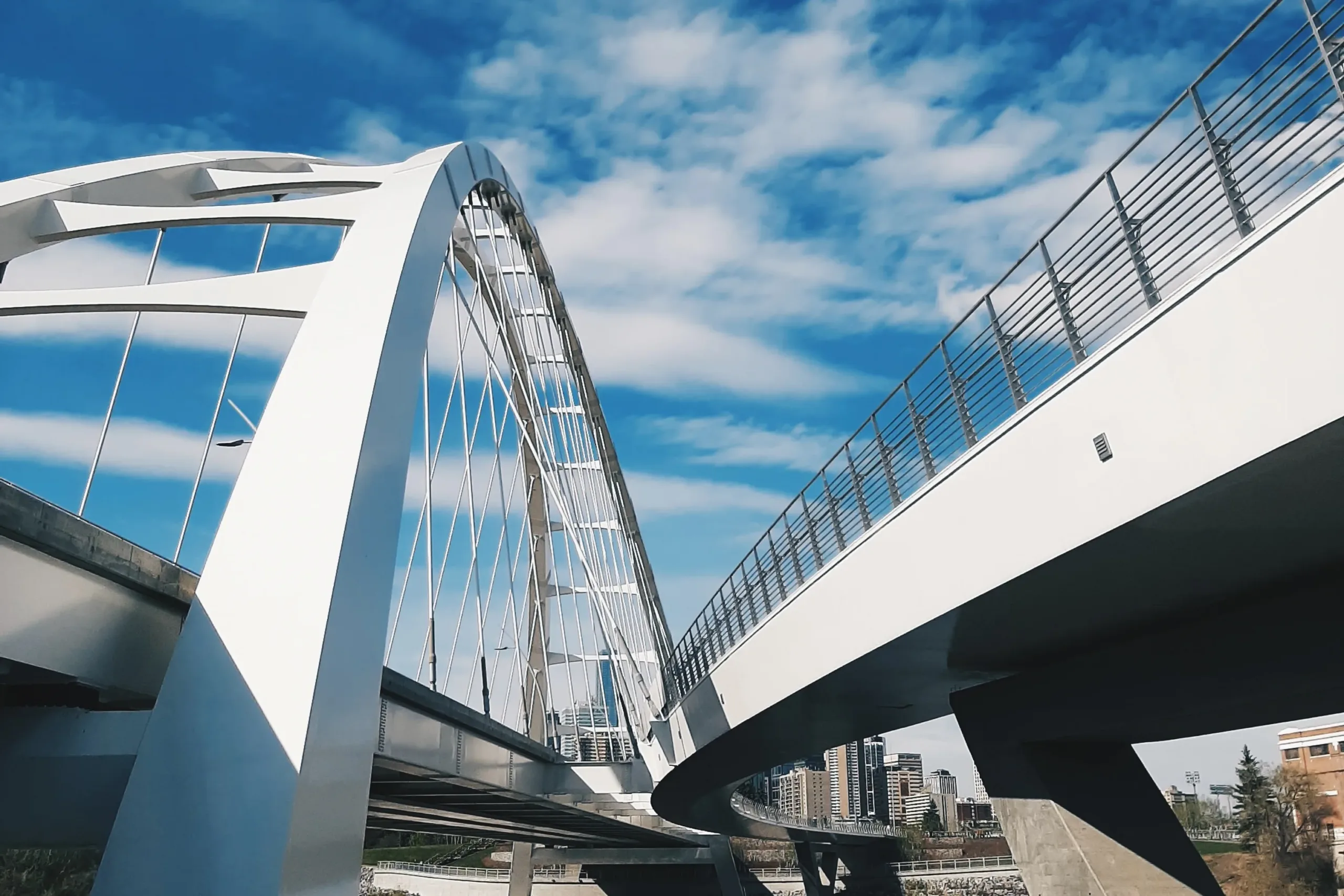

Co-invest alongside experienced and well-capitalized developers in ground-up projects located in major Western Canadian markets.

Gain unique exposure to the real estate sector by participating in higher returns related to private early-stage growth companies.

Track record

Our history demonstrates disciplined investment selection and management, achieving strong partner returns in-line with investment mandates:

| Strategy | Fund | Target return | Actual/projected returns | Investment status | |

| Real estate debt | KV Mortgage Fund | GOC 2-year bond + 4.5% | Fund IRR since inception | 8% | Open |

| Operating company private equity | KV Private Equity Fund I | 15%-20% IRR | Net IRR (realized) | 20.64% | Closed |

| KV Private Equity Fund II | +20% IRR | N/A (in deployment) | Open | ||

| KV Private Equity Fund III | +20% IRR | N/A (in deployment) | Open | ||

| Real estate private equity | KV Real Estate Equity Partners Fund I | 12%-14% IRR | Net IRR (projected) | 14% | Closed |

| KV Real Estate Equity Partners Fund II | 12%-14% IRR | N/A (in deployment) | Open | ||

Disclaimer

Actual returns may vary significantly from target rates of return, which are based on certain assumptions and projections. Past performance does not guarantee future performance. Results are not guaranteed. See [Terms of Use | Legal].

Learn about our fund offerings here.

Relevant insights

-

KV Capital Real Estate Equity Partners Launches Fund II

Fund seeks growth by addressing continued demand for real estate development investment.

-

Inaugural KV Capital Real Estate Equity Partners Fund now fully committed

Full commitment of capital signals new phase of growth.

-

KV Capital launches building products strategy by adding veteran industry CEO to its operating company private equity team

Paul Verhesen, past president & CEO of Clark Builders, brings strategic insights to KV